🔥 This offer expires in:

🔥 This offer expires in:

For Everyday Earners Struggling to Escape the Credit Card Trap

27 Proven Strategies to Wipe Out Credit Card Debt & Reclaim Your Financial Freedom in 30 Days -Without Living on Ramen or Picking Up a Second Job

Without slashing every expense to the bone, taking out another risky loan, or listening to financial “experts” who’ve never been in your shoes. The Credit Card Debt Fix is your no-BS, step-by-step roadmap to breaking free from high-interest debt—without feeling broke, overwhelmed, or stuck in financial quicksand.

4.8 / 5 based on 1,931 reviews

JOE NORRIS

TEACHER & DAD OF 3

I was completely stuck—making only the minimum payments, watching my balance barely budge, and drowning in interest charges. I had no idea how the 'system' was working against me, but now it’s so clear. Getting this guide was a total game-changer. I saved more than the cost of it in just one move, and now I finally have a clear plan to get out of debt for good. The best part? I’m back in control of my money—no more stress, no more sleepless nights.

INTRODUCING THE CREDIT CARD DEBT FIX

62% of Americans Are Stuck in a Credit Card Debt Trap -Break Free Today.

Is Your Credit Card Helping You or Holding You Back?

Every year, millions of hardworking people like you fall deeper into credit card debt—without even realizing why. You make payments month after month, yet with interest rates averaging 21.5%, your balance barely moves. Meanwhile, banks collect billions in profits from these high-interest charges, keeping you stuck in a cycle that feels impossible to escape.

This guide offers a different way forward. Instead of letting your money disappear into interest payments, you’ll learn 27 proven strategies to take control of your debt, cut down what you owe, and start moving toward true financial freedom.

It’s time to stop working for the banks and start working for yourself—with smart, practical debt-fighting tactics that don’t require extreme budgeting, cutting out everything you love, or picking up a second job.

The system is rigged against you. This guide helps you fight back.

Stop Letting 21.5% Interest Bury You in Debt

The average credit card interest rate is 21.5%, meaning that for every $1,000 you owe, you’re paying an extra $215 per year—just in interest. If you’re only making minimum payments, it could take decades to escape the cycle.

This guide reveals 27 proven strategies to cut your interest, lower your payments, and finally take control of your finances—so you can stop giving your hard-earned money to the banks and start building a future without debt.

It’s time to flip the script—get out of debt faster and keep more of your money where it belongs.

Escape the Credit Card Trap Like the Top 1%

The wealthiest 1% don’t drown in credit card deb —they use the system to their advantage.

They negotiate lower interest rates, restructure payments, and leverage financial loopholes to stay ahead, while everyday people pay 21.5% interest and barely make a dent in their balances.

This guide reveals the exact strategies the financially savvy use to cut down debt fast, avoid paying thousands in unnecessary interest, and break free—without needing a six-figure income. If you’re tired of working hard while your credit card balance barely moves, it’s time to fight back with the same insider tactics used by those who refuse to stay trapped.

The rules aren’t the same for everyone—but after this, they will be for you.

Credit Card Companies Profit While You Drown in Debt

Ever wonder why credit card companies approve you so fast but make it nearly impossible to pay off your balance? It’s because they profit off you staying in debt.

They lend you money at 21.5% interest while paying less than 1% on savings accounts, stacking the deck in their favor.

This guide reveals how to turn the tables —lower your interest, cut your debt faster, and stop making banks richer while you struggle.

The system is designed to keep you paying forever —unless you know the right moves to break free.

It’s time to make your money work for you, not them.

Slash Your Debt in Under 5 Minutes a Week

Getting out of credit card debt doesn’t have to be overwhelming, time-consuming, or confusing —even though banks want you to think it is (I wonder why…). The truth is, with the right strategies , you can start cutting your debt in just 5 minutes a week —without extreme budgeting, living on rice and beans, or picking up another job.

This guide walks you through simple, proven steps to lower your interest, reduce payments, and finally make progress—fast.

No fluff, no financial jargon—just real results, without the stress.

If you have 5 minutes, you can start today.

MORE THAN JUST A GUIDE

Debt Freedom is Power—Introducing Your Ultimate Shortcut...

The moment you grab your copy, you’ll get instant access to all 27 proven strategies that have helped thousands break free from credit card debt—without the stress, confusion, or endless struggle.

In just a few clicks, you’ll unlock step-by-step instructions, negotiation scripts, and debt-busting techniques designed to help you cut interest, lower payments, and finally take control of your finances.

This isn’t just a PDF—it’s your fast track to financial freedom.

1. Why Credit Card Debt is Keeping You Stuck...

Here's the content:

Part 1: The Hidden Traps of Credit Card Debt

Part 2: Why Minimum Payments Keep You Paying for Decades

Part 3: How Banks Profit Off Your Debt & What You Can Do About It

2. 27 Proven Strategies to Escape Credit Card Debt Fast...

Here's the content:

Part 1: How to Reduce Interest Rates (Even If You Have a Low Credit Score)

Part 2: The Best Repayment Methods to Cut Debt Quickly

Part 3: How to Negotiate Your Balance & Pay Less Than You Owe

3. The Financial Freedom Formula...

Here's the content:

Intro: How the Debt-Free Build Lasting Wealth

Part 1: Eliminating Debt to Free Up More Cash for Your Future

Part 2: Creating a Sustainable Budget That Works for You

Part 3: The Best Ways to Start Growing Your Money (Even If You’re Starting at $0)

4. Transform Your Finance In Just 30 Days

Here's the content:

Intro: Your Debt-Free Roadmap—Why This Works in 30 Days

Week 1: Conducting a Financial Reality Check & Setting Your Debt-Free Plan

Week 2: Slashing Expenses, Lowering Interest, and Negotiating Debt Down

Week 3: Implementing High-Impact Debt Reduction Tactics (Balance Transfers, Snowball vs. Avalanche)

Week 4: Locking in Your Progress—Setting Up Systems to Stay Debt-Free for Life

5. Resources, Tools, and Next Steps To Stay Debt Free...

Here's the content:

Intro: The Best Free & Paid Resources to Keep You Out of Debt for Good

Part 1: Essential Debt-Tracking & Budgeting Tools

Part 2: Credit Score Boosting Strategies & Financial Protection Apps

Part 3: Smart Money Habits to Maintain a Debt-Free Life

6. Taking Control of Your Financial Future...

Here's the content:

Part 1: How to Change Your Money Mindset & Stay Out of Debt for Good

Part 2: Building Financial Independence Without the Overwhelm

Part 3: Your Next Steps—Creating a Plan for Continued Success

BREAK FREE FROM THE CREDIT CARD TRAP: GET OUR $1,587 VALUE WEALTH BUILDING STEPS FOR JUST $17!

4.8 / 5 based on 1,931 reviews

Exclusive Bonuses Just For YOU!

Along with the Debt-Free System, you’ll get special bonuses designed to supercharge your financial success. These powerful extras help you pay off debt faster, stay on track, and build long-term financial stability. Act now to unlock these exclusive tools—available for a limited time!

BONUS 1: The Credit Card Interest Hack Cheat Sheet

Discover the exact negotiation scripts and step-by-step process to get your credit card interest rates reduced—even if you have a low credit score.

BONUS 2: The “Debt-Free in 30 Days” Daily Checklist

Stay on track with a proven, structured 30-day plan that walks you through every action you need to take to cut debt quickly and stay in control.

BONUS 3: The Ultimate Budget & Debt Tracker Spreadsheet

Easily monitor your debt payoff, interest savings, and financial progress .

BONUS 4: 12 Hidden Bank Loopholes to Save Thousands

Learn insider secrets banks don’t want you to know—ways to legally bypass fees, reduce interest, and protect your hard-earned money.

BONUS 5: 8 Extra Income Hacks to Pay Off Debt Faster

Quick, 10-minute-a-day income streams that help you free up cash for faster debt repayment without sacrificing your time.

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

SARAH LEWIS

Small Business Owner

"I always thought I was doing the right thing—paying down my credit cards, making minimum payments—but this guide blew my mind. I had no idea how much I was actually overpaying in interest! Just one move from this guide saved me more than what it cost. I finally feel like I’m in control instead of just surviving month to month."

Verified Review

DAVID CHEN

Engineer & Investor

"I always wanted to get out of debt, but it felt impossible. This guide lays it out step by step. No fluff, no overwhelm. I followed the strategies, and in just a month, I’ve already shaved off thousands in interest. I finally have a plan that works!"

Verified Review

EMILY REED

Freelancer & mom of 2

"I didn’t realize how much banks were profiting off me until I read this. Just changing one thing with my payments saved me hundreds in fees and interest. It’s like I was playing the game wrong this whole time, but now I know how to win."

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

"I used to think I’d be stuck in debt forever. Every month, I made payments, but my balance barely moved. This guide gave me a clear roadmap, and now, for the first time, I can actually see my debt going DOWN instead of just treading water."

Verified Review

JASMINE PATEL

College student & part-time worker

"People always say, ‘Just pay off your debt!’ but no one tells you how to do it without feeling broke all the time. This guide changed everything for me. I finally feel like I have a real plan, and I’m actually excited about my finances for once!"

Verified Review

MICHAEL GONZALEZ

Marketing professional

"I’ve been stuck in the credit card cycle for years, just assuming I had to live with it. Wrong. This guide showed me how to cut my payments, lower my interest, and actually make progress. If you’re thinking about getting this, don’t wait—it’s already paid for itself!"

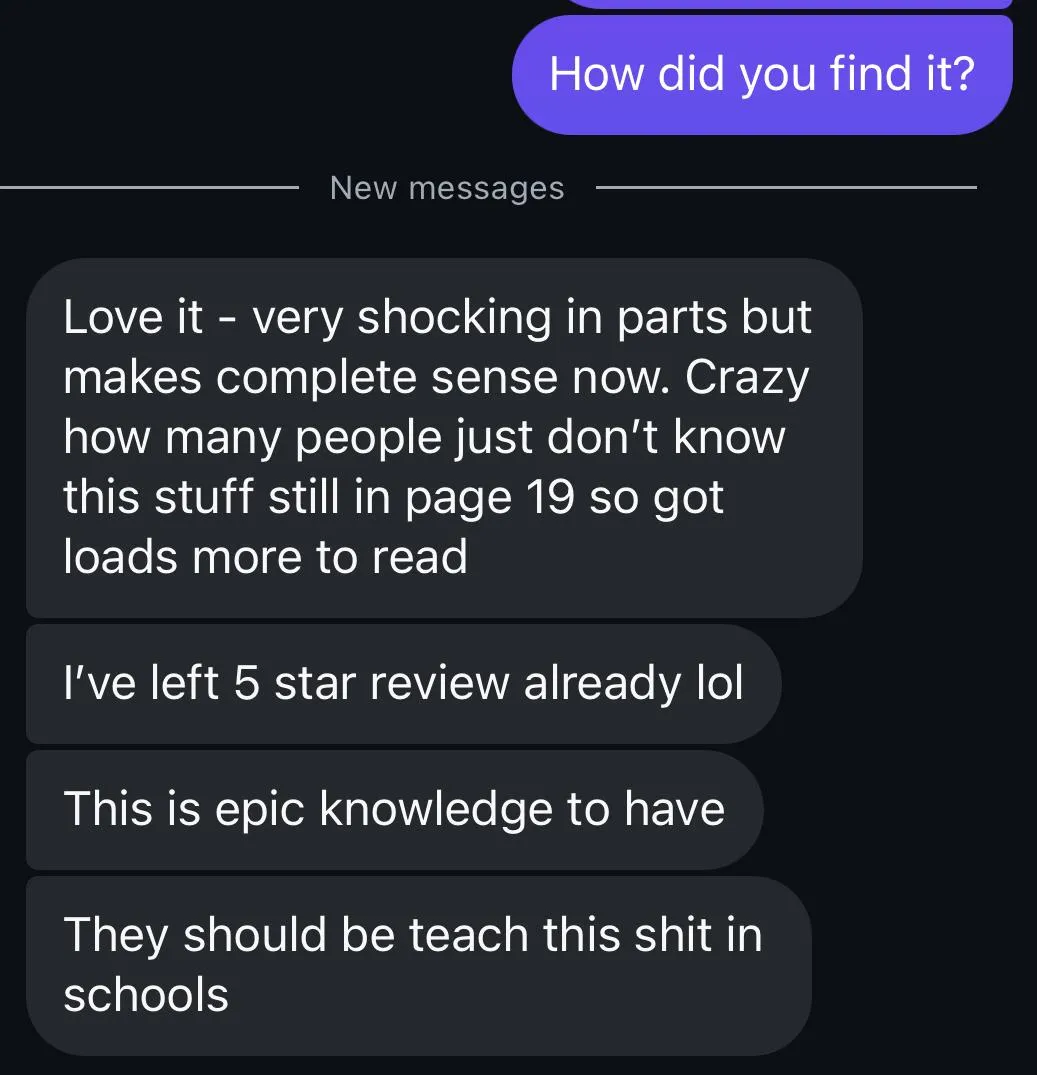

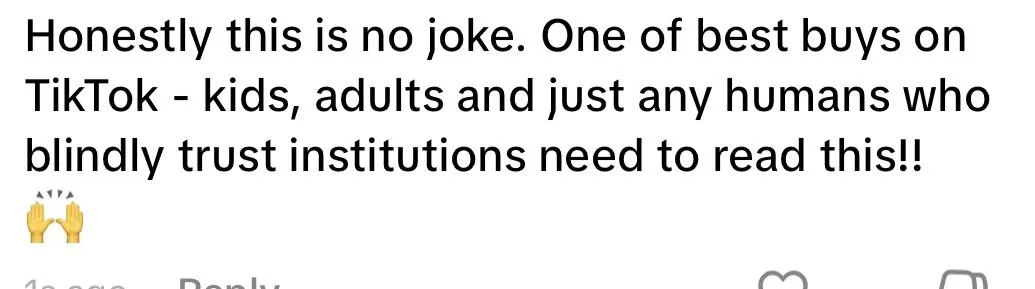

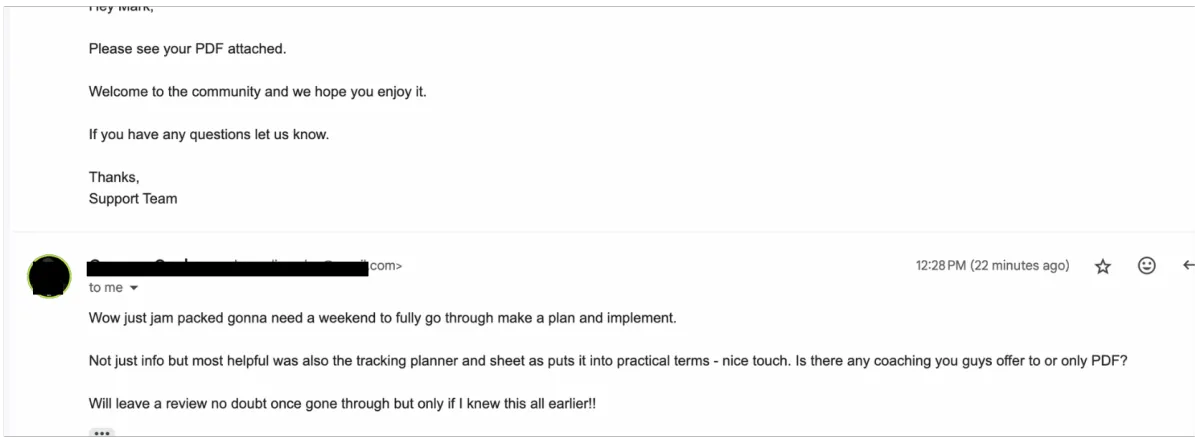

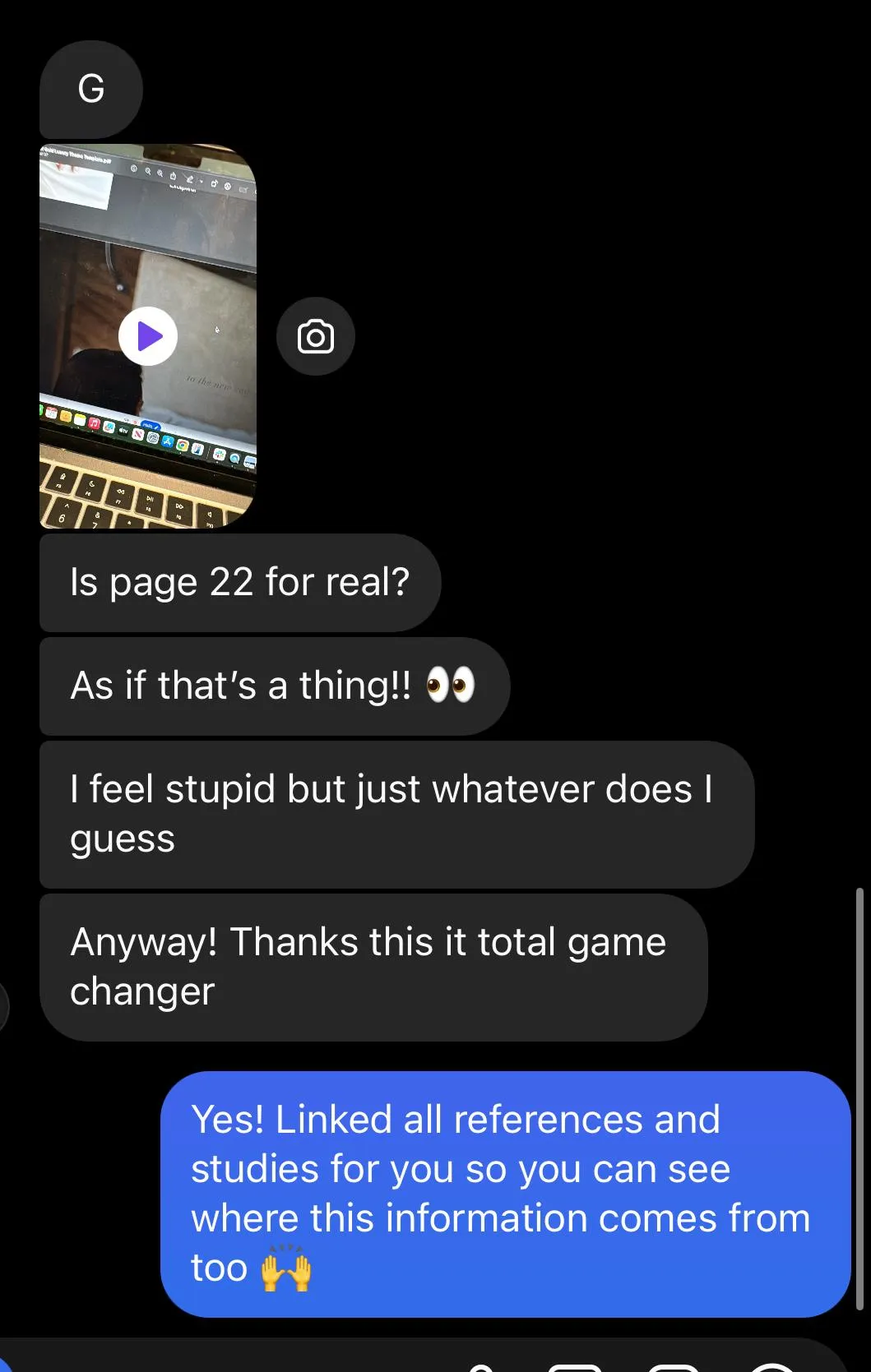

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The Credit Card Debt Fix Guide Today!

With this bundle, you’ll get immediate access to powerful, step-by-step strategies to break free from the debt cycle and stop letting banks profit off you. For a limited time, grab this complete debt crushing system at an unbeatable price. Don’t wait—start your journey to financial freedom today!

CREDIT CARD DEBT FIX GUIDE

$17 USD

VAT/Tax Include

4.8 / 5 based on 1,931 reviews

Full 30+ Page Credit Card Debt Fix Guide

BONUS 1: The Credit Card Interest Hack Cheat Sheet

Get negotiation scripts and proven methods to lower your credit card interest rates—even if you have bad credit.

BONUS 2: The “Debt-Free in 30 Days” Daily Checklist

Stay on track with a proven, structured 30-day plan that walks you through every action you need to take to cut debt quickly and stay in control.

BONUS 3: The Ultimate Budget & Debt Tracker Spreadsheet

Easily monitor your debt payoff, interest savings, and financial progress with this simple yet powerful Excel template.

BONUS 4: 12 Hidden Bank Loopholes to Save Thousands

Learn insider secrets banks don’t want you to know—ways to legally bypass fees, reduce interest, and protect your hard-earned money.

BONUS 5: 8 Extra Income Hacks to Pay Off Debt Faster

Quick, 10-minute-a-day income streams that help you free up cash for faster debt repayment without sacrificing your time.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through why credit card debt keeps you stuck and how to erase it in just 30 days using 27 proven strategies. You’ll learn step-by-step how to lower interest rates, negotiate balances, and pay off debt faster—all without extreme budgeting or sacrificing everything you love.

Is this guide suitable for beginners?

Absolutely! This guide is designed for anyone struggling with credit card debt—whether you’re completely new to managing debt or have tried other methods that didn’t work. We explain everything in clear, simple terms with actionable steps anyone can follow.

Do I need a lot of money to start?

Not at all! In fact, this guide is built for people who feel like they don’t have extra money to throw at their debt. You’ll learn real strategies that work for any budget, including ways to reduce your payments and free up cash without earning more.

How quickly can I see results?

Some changes—like negotiating lower interest rates or avoiding hidden fees—can bring instant savings. Others, like using the right repayment strategy, can dramatically speed up your debt payoff timeline. Many users report seeing major progress in just 30 days.

Will this guide work for me if I’ve tried paying off debt before?

Yes! If you’ve tried paying off debt and still feel stuck, this guide will show you exactly what’s holding you back.Instead of just telling you to “pay more than the minimum,” we give you real, strategic methods that help you eliminate debt faster while paying less overall.

What resources come with the guide?

Along with the 121-page guide, you’ll get these powerful bonuses:

✅ The Credit Card Interest Hack Cheat Sheet – How to lower your interest rates fast

✅ The “Debt-Free in 30 Days” Checklist – A step-by-step roadmap so you never feel lost

✅ The Ultimate Budget & Debt Tracker – Track your progress & see your debt shrink

✅ 12 Hidden Bank Loopholes to Save Thousands – Learn how to outsmart the system

✅ 8 Extra Income Ideas to Pay Off Debt Faster – Quick ways to free up cash in under 10 minutes a day

How is this different from free advice I can find online?

Great question! Unlike random blog posts or YouTube videos, this guide brings everything together in one place, step-by-step, with proven strategies that work. Instead of wasting hours searching for scattered advice, you get a complete system that makes it easy to take action and see results.

Is there a guarantee if I’m not satisfied?

Because this is a digital product with instant access, we can’t offer refunds. However, we’re confident that if you apply even one or two strategies from this guide, you’ll save more than what you paid for it—just like thousands of others have!

4.8 / 5 based on 1,931 reviews

All rights reserved PRIME PREMISES LLC

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.